If you’ve been paying any sort of attention to the housing market, you know that things are still quite expensive right now. Even with the Fed’s attempts to lower demand by increasing the interest rate, leading to mortgage rates that are higher than what we’ve been used to for the last 10 to 12 years, it seems (anecdotally) that people are still buying and selling Though still historically low, 6-7% on a house that cost $350,000 today versus a house that cost $150,000 10-12 years ago has many buyers in a tailspin. Even when accounting for wage increases during this time, housing affordability is still an issue for our community and over the last 2 to 3 years seems to be getting worse.

Looking at this chart, we can see that housing generally was more affordable in Tucson between 2009 to 2020 with the share of affordable housing above 70% for all years except for 2018, when the percent of affordable housing dropped to 66.44%. P0eak affordability appeared in 2012 when the percent of affordable housing rose to 86.22%. You can see that the percent of affordable housing begins to dip in 2021 and then drops precipitously from 2021 to 2022 with the percent of affordable housing falling to 46.95%. This is similar a similar level to affordability in 2005 (45.53%). You can see that affordability got much worse between 2005 – 2007 and then began to rise in 2008.

If you’re old enough, I think you remember what was happening between 2005 – 2007 and then what abruptly followed in 2008 (the housing boom and bust). I’m not going to get into that whole fiasco in this post right now, but it makes one wonder what the data will show for 2023 and 2024? Will affordability continue to drop? Or will the impact of the Fed’s interest rate hikes and more building tamp down demand and increase supply enough to lower prices? Only time will tell. But let’s focus on today and the point of this blog post. What can the typical family actually afford in Tucson?

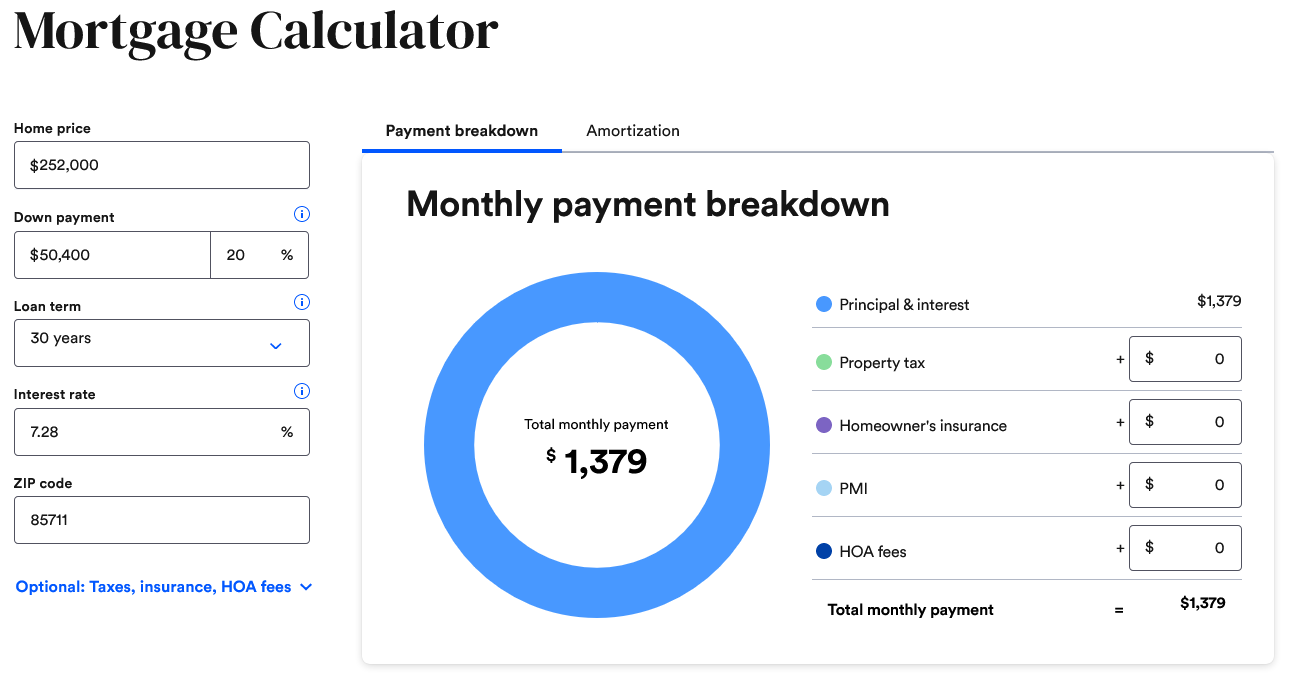

To answer this question I am going to employ a few assumptions. I’m going to employ the 28% rule for housing budget. If you’re unfamiliar, this rule basically states you should not use more than 28% of your pre-taxed monthly income on your mortgage. And I’m going to use the median household income for Tucson as of 2021 which was $59,215 (quite the jump from 2015 when the median household income was $46,162). This comes out to about $1382 per month of income that should be used to pay your monthly mortgage. Using Bankrate.com’s mortgage calculator the following assumptions were used to come up with the total cost you can spend on housing: A 30 year, conventional mortgage with an interest rate of 7.28% (which is the national average), and a 20% down payment on a single family home, not considering property taxes, homeowner’s insurance or HOA fees.

So, it looks like you’re max house hunting budget is going to be $252,000 (again not taking into account property taxes, etc. which would make this budget realistically a few thousand dollars less). But let’s see what kinds of single family homes we can find in Tucson in the $240,000 – $250,000 price range. Let’s say we want at least 3 bedrooms and 2 bathrooms (a typical family home). We’ll make no priority for location or size. Let’s just see what Tucson has to offer us in our price range.

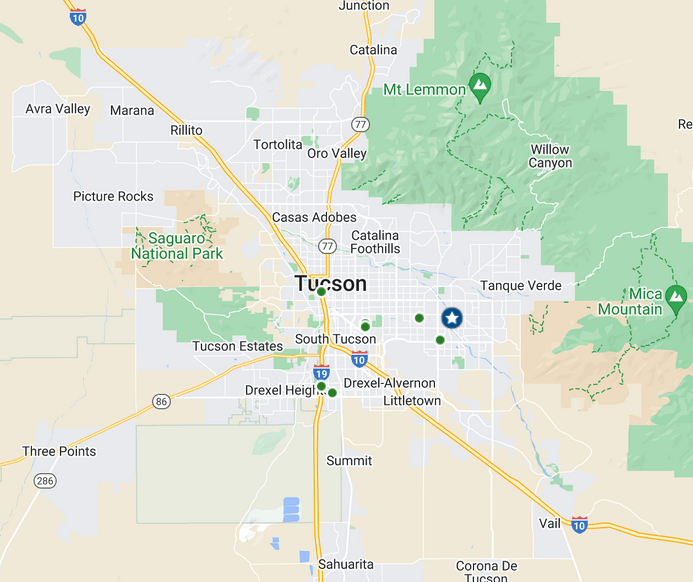

My search showed a surprising lack of inventory! There were only 18 homes available for sale (or soon to be available for sale), of those, 10 already had offers, leaving me with only 8 homes that were coming soon or are actively on the market without a contract.

What You get for $240,000

This is a 1963 brick ranch home on a 10,086sf lot. It has 1458sf, 3 bedrooms and 2 bathrooms. It also has an in-ground pool and spa! Although you would have to fill it yourself and make any necessary repairs. This one is listed as a “Fix Up” and being sold “As-Is”, so hopefully you have some handyman skills or are an investor. The upside is that the repairs look mostly cosmetic, but you’ll definitely want a home inspection on this one. (Note: I started this blog post on 8/1, and this house is now under contract as of 8/2 before publishing this post. With such low inventory, expect things to go fast!)

The Biggest Home for $250,000

This is the biggest home you’ll find listed for sale; a 1610sf 3 bedroom 2 bathroom home on a 11,760sf lot. Built in the 1950s, the home has evaporative cooling rather than refrigerated air and looks to be in okay shape. Like many of these homes, you will likely have to repair/replace/update items. The biggest drawback to this one: You’re right across the street from the railroad, meaning you will hear the trains go by. But if that doesn’t bother you, you’ll enjoy a nice sized house on a large lot. And you’ll be within walking distance of a new casino (if that’s your thing)! This one is also listed as a “Fix Up” and “Estate” sale. So you could probably get an even better deal through negotiations.

A Remodeled Home at $250,000?

It is possible! I found this newly listed home for sale at $250,000 with a near totally remodeled interior. It is a 1247sf, 1959 Mid-Century modern ranch style home on a 7667sf lot. The exterior looks like it may need some paint, but the interior is gorgeous. The home is on a cul-de-sac, and has forced warm and central air conditioning.

To see all 8 homes go here (keeping in mind these homes may have already gone under contract or have been sold).

Your Thoughts?

What do you think about housing affordability in Tucson or where you live? Do you think we’ll see affordability drop further like it did between 2004-2007? Or do you think we’ll see more affordable housing in the next few years? Were you surprised by what one could afford at a $240,000 – $250,000 price range in Tucson? Let me know!